The blackout that plunged Iberia into chaos is fast becoming a masterclass in finger-pointing and the Spanish government’s official report hasn’t done much to calm the waters. Delivered just seven weeks after the event, it ticks the boxes on vague diagnostics (“multifactorial issues”) and spreads the blame evenly: the grid operator Red Eléctrica, for not managing voltage stability, and the plant operators, for allegedly tripping off at the worst possible moment. But for anyone with even a basic understanding of how power systems work, this all feels rather undercooked. And you can’t help but suspect the rush to produce a report was more about political optics than real answers. The result? More questions than clarity.

Red Eléctrica’s reaction has been, to put it politely, all over the place. Firstly, they blamed the gas generators for failing to pick up the slack when system inertia dropped. Then, once the unredacted version of the report came out, they pivoted: now it’s too much inertia and the finger is pointed at Iberdrola’s big solar farm in Badajoz, right on the Portuguese border, which they claim was the first domino to fall.

Now, let’s say for argument’s sake that the Badajoz plant did trip first. So what? Plants of that size (just under 400MW) trip all the time around the world without causing an all-out grid collapse. The question we should be asking is: why was the Spanish grid so fragile in the first place?

The government report waves away fears of a cyberattack but is light on anything technical. Storage? Automated response? Demand flexibility? Interconnection? Generator protection settings? Where has Red Eléctrica been on all this?

Let’s talk storage. Spain has 3.5GW of projects ready to go. But no surprise here they’re stuck in regulatory limbo. Operators can’t commit capital if they don’t know how they’ll get paid, and Spain’s competition authority is still waiting on signoff from Brussels. The result? Low cost batteries that could have really helped the situation sitting idle while the grid wobbles.

As for other resiliency measures, things get murky fast. I’d be keen to hear from Spanish grid experts, what exactly is the current state of the national grid code? What’s required from generators? Because whatever is in place it clearly isn’t enough.

Then there’s utitity Iberdrola. They hold all the operational data on the Badajoz solar plant in their SCADA (control) systems. They know exactly what happened at Badajoz. But whether they’ll reveal that data, and when, is anyone’s guess.

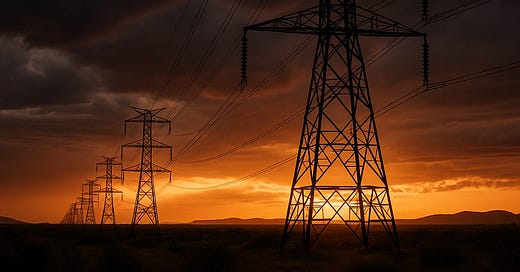

Here’s the bigger issue: this isn’t about renewables failing. It’s about years of underinvestment in the grid. For every euro Spain invests in clean generation, only 30 cents go into the grid. The EU average? More than double that. It’s systemic neglect, not solar panels, that’s to blame.

Solar is the cheapest energy source in history. The energy transition now makes sense on economics alone. And just as investing in renewables pays dividends, so too does investing in the grid: every euro spent on transmission saves over two euros in system costs by 2040, according to the European association of grid operators ENTSO-E.

ENTSO-E will publish a report on the Spanish blackout later this year, but the takeaway is already clear: modern, flexible grids are no longer a luxury they’re the foundation for delivering cheap, reliable, and clean power, and without that power modern life as we know ceases to exist. Spain has just provided Europe and the rest of the world an expensive reminder of the importance of electricity. And we need to learn from their mistakes.